Physician Financing

Doctor Loans, also called Doc Finance, are exclusive money offered by certain mortgage brokers in order to dentists, orthodontists, optometrists, specific veterinarians, and doctors.

Medical practitioner Loan (Medical professionals Finance) Are available to an exclusive gang of Physicians.

Of numerous dentists, optometrists, ophthalmologists, veterinarians, specialist, and you may doctors (DO/MD/IMG) when they provides a residence price can qualify for a good doctor’s loan.

What are doctor/doctor finance?

- Money which can be given to a personal selection of doctors upwards to help you $1M in the higher cost of way of life parts

- Such finance dont account fully for education loan obligations when figuring loans-to-money percentages.

- Most home and you will fellows are capped during the credit $750,000.

- Fund having 0% off also called 100% investment. You’ve got a downpayment when you yourself have a limited borrowing records, a credit history lower than 720, or if perhaps the fresh new appraisal of the house is available in underneath the cost.

- Gift finance on the closure rates are believed toward medical practitioner financing

- Sadly, co-signers that do not live-in the house because their number one household are not desired.

Whenever is it possible you qualify for a health care professional Financing?

Whenever the doc features an agreement and commence big date verified by their/their personnel, she/he can make an application for a health care provider financing. The start go out of your own financing (closing go out of brand new home) can be very early as two months before the begin go out. Lenders might need the latest selling off a prior family just before first big date given that mortgage to your another home will get perception your debt to income ratio. This should towards a per person scenario.

The latest 60-time window to have closing are extremely helpful to scientific people who Meets otherwise Soap on a residence. As soon as your coming company provides you with a confirmation letter of one’s a career begin time, americash loans Valley Grande you might make an application for a health care professional financing as well as romantic on the your property two months in advance of one begin day. An earlier romantic go out allows medical professionals so you’re able to move in and you may accept to their the fresh new house with an increase of flexibility.

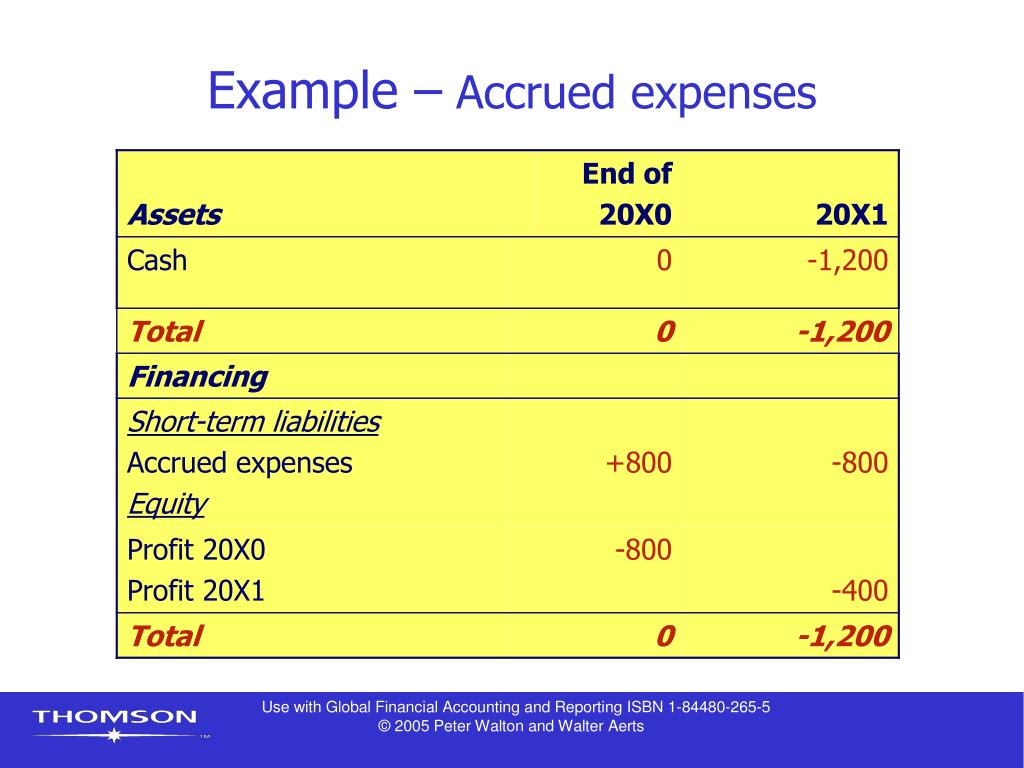

If for example the financial is $1200 then make certain to conserve $2400 including settlement costs. Don’t have sufficient to have a two-week reserve? A family member might also present the amount to prove one you have sufficient fund getting mortgage repayment in advance of the first pay view.

How much cash will we meet the requirements so you’re able to borrow on a physician Financing?

Medical professionals mortgage (mortgage) is going to be around $750K, depending credit rating, debt-to-money proportion of the applicant and one cosigners. Regrettably, it mortgage merely pertains to top household and you can really does excluded trips otherwise leasing attributes (conditions handled at the end off web page).

Ex lover. Should include a wall with the yard but don’t provides the money so you can free? The lending company does not will let you in the amount borrowed to provide including the new fence.

Ex lover.dos You close into a property nevertheless vendor cannot security the price of repairs toward an inspection goods, eg a reduced a beneficial/c. This will be around new debtor to pay for aside out-of wallet. The total amount to own resolve of good/c cannot end up being lent. Including settlement costs towards the loan is not typical.

The vendor also can merely lead to dos% of your own loan for closing rates whenever credit ninety%+ of one’s transformation cost of the home. This may significantly change the amount of cash a purchaser need to shut towards family. Ex lover. A supplier can only contribute $4,000 to the closing costs on the an excellent $200,000 sale. Some real estate agents have no idea of that it plus the bank try usually not creating the newest formula or offer this on consumer’s interest.