The newest You.S. Company regarding Agriculture (USDA) built the new Outlying Development Mortgage system, labeled as this new OneRD Make sure Loan Effort to help you prompt personal lending, investment, and you will economic growth in outlying groups across The usa. Which effective system, released inside , was created to help advertisers in outlying elements start, supply and you may develop its enterprises. These types of money have several advantages as well as glamorous interest rates, enticing repayment terms, and also practical borrowing from the bank and security conditions. But possibly the most attractive basis ‘s the high loan numbers considering. Indeed, Simply how much resource can i get out-of a great USDA Outlying Invention Mortgage? is one of the very first and most frequent concerns we have been asked about OneRD Fund in the Northern Path Resource. The solution utilizes the specific program prepared play with toward mortgage. However, one to commonality is that loan limits are common the, particularly compared to the typical SBA finance.

USDA Rural Advancement Team & Community (B&I) Mortgage Limitations

The latest USDA keeps a number of different Outlying Creativity Loan software that it has the underside the OneRD Step. They’ve been the company & Business Protected Loan Program (B&I), the community Organization Mortgage program (CF), additionally the Outlying Times for The usa Program (REAP), and others.

The B&I Guaranteed Mortgage system ‘s the USDA’s largest and most well-known OneRD program with more than $step 1,940,442,000 when you look at the capital designated in 2021. NAC try America’s USDA Organization & Business Loan financial. The fresh new B&We system serves a general list of having-finances and you can nonprofit organizations, co-ops, personal government, and you may federally accepted tribes, together with startups and you will present enterprises.

Funds are used for team purchase, advancement, extension, transformation, fix and you can modernization, the purchase regarding list, gizmos, and you will provides, a home, strengthening, and you may system acquisition and you will advancement, refinancing financial obligation, plus.

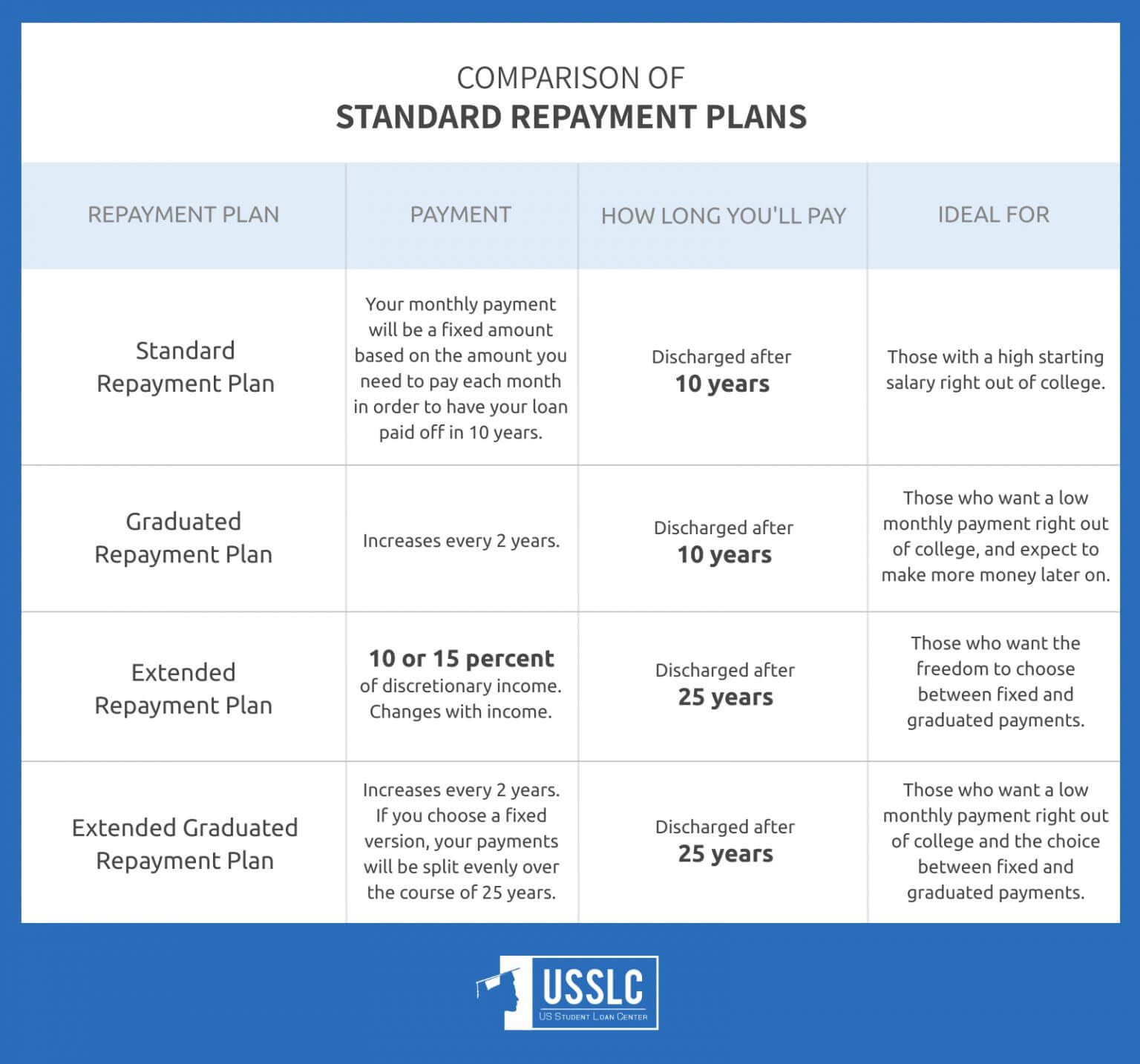

Beneath the brand new OneRD direction, restrict B&I Loan number is $twenty five billion quite often or over to help you $forty mil having rural cooperatives one techniques certain worthy of-additional farming products, at the mercy of recognition. Conditions getting B&I Financing is stretch out to three decades. He’s lay by the lender depending the brand new helpful economic life of brand new possessions getting funded, along with people used since the guarantee, as well as the borrower’s fees abilitypare them to SBA eight(a) commercial loans, which happen to be capped just $5 billion that have twenty-five-seasons limitation terms, therefore start to rating a sense of why these financing are so enticing.

It must be listed one to B&We Financing, and the most other OneRD loan efforts, is actually collateral-backed lending applications; that’s, a borrower should certainly securitize its asked funding number. B&I Loans, such as, have to be collateralized having fixed property (cash, assets, gizmos, an such like.) off an equivalent worth on loan amount questioned. For each and every repaired advantage features its own categorized disregard speed. Such as for instance, real estate is actually discount of the 20% appraised well worth and you will devices and equipment from the 40-60% appraised really worth.

USDA OneRD Community Business (CF) Loan Program Restrictions

The brand new USDA Society Studio Financing system will bring lending service to possess important area place, social security, and you may community recreation establishment into the rural areas. An enthusiastic very important area facility is described as a general public improve, run into the an effective nonprofit foundation, you’ll need for the newest orderly growth of an outlying society, where community was a neighborhood, city, county, otherwise multiple-county town. Funds are often used to create, expand, otherwise boost crucial neighborhood place, plus for both bodily structures and you may/or perhaps the features to-be agreed to outlying customers and you will businesses.

Examples of very important neighborhood place is:

- Medical care institution and you will qualities

- Medical facilities -personally stored

- Flames, save yourself, and you can societal safeguards business and features

- Neighborhood, https://paydayloancolorado.net/hasty/ societal, personal, instructional, otherwise cultural institution, as well as neighborhood parks and you will hobby locations

- Transport establishment (streets, links, roads, slots, and you will airports)

- Power methods, gas distribution solutions, and recycling otherwise transfer stores you should definitely qualified to receive Rural Resources Solution funding

- End-affiliate communication gizmos having social safeguards, scientific, or instructional objectives when not entitled to Rural Resources Solution financial support

- Liquid structure (levees, dams, reservoirs, inland lakes and rivers, streams, and you will irrigation systems)

Before OneRD system news, there were no CF program credit thresholds. The newest assistance lay limit CF Loan number at $100 million. For example both protected and you will unguaranteed servings of the mortgage, and additionally (in new OneRD direction), the balance of any existing CF Protected Fund while the this new CF Secured Financing request. In lieu of B&We Money, terminology is actually capped at 40 years having lenders deciding final words based upon financial support play with (the fresh new of good use life expectancy out-of financed property), the newest property put given that guarantee, together with borrower’s capability to pay-off.

USDA OneRD Outlying Opportunity having America Program (REAP) Financing Limitations

Underneath the USDA Outlying Creativity Financing program’s Rural Times to possess America Program (REAP), this new USDA brings secured financing resource and you may give investment in order to outlying smaller businesses and you will farming providers having renewable power assistance and you can/otherwise energy savings advancements. Agricultural firms should be able to demonstrate that at the least fifty% of their income comes from agricultural procedures. Qualified individuals should not have any the government taxes, judgments, bills, or debarments.

- Biomass, including biodiesel, ethanol, anaerobic digesters, and you will strong fuels

Northern Avenue Money has the benefit of USDA Reap Finance doing within $2 million which have limitation 29-year terms and conditions with final terms and conditions becoming place from the financial with the a situation-by-situation basis, according to the useful financial lifetime of this new assets being financed and you may property put because the security, together with borrower’s repayment element. The new USDA Experience system has the benefit of provides and you may financing/provides off $20,000 or shorter and that’s acquired in conjunction with a USDA Enjoy loan.

Why Prefer North Path Funding?

For additional info on the fresh USDA’s Rural Development Mortgage system (OneRD), including its Team & Globe (B&I) Financing Program, Neighborhood Place (CF) Mortgage Program, and Rural Opportunity to possess The usa Program (REAP), get in touch with Northern Method Financing. We are lead loan providers, who do work having people throughout 50 states and you can You.S. territories. We can respond to all of your current questions regarding the fresh new terms and conditions and certificates getting OneRD Funds and help walk you through the application form techniques.